The 2023 headlines have been dominated by geopolitical conflicts and economic uncertainty as well as surging inflation and consequential interest rate hikes.

Despite these challenges, global economies have displayed surprising resilience, with recent inflation figures suggesting a turning point, according to property specialist Knight Frank’s Global Prime Residential Forecast for 2024 report.

“While two major geopolitical crises unfold, presenting human tragedies and potential global economic implications, astute observers note varying approaches among central banks,” said Kate Everett-Allen, head of international research at London-based Knight Frank, in her report.

“Leaders in Canada and the U.K. have signaled their intent to address inflationary risks linked to higher oil and gas prices,” she said. “In contrast, counterparts in Europe and the U.S. appear more relaxed in their stance.

“Amid this backdrop, the ‘higher for longer’ trend persists, leading to a notable shift in buyer behavior.”

Money is on taxes

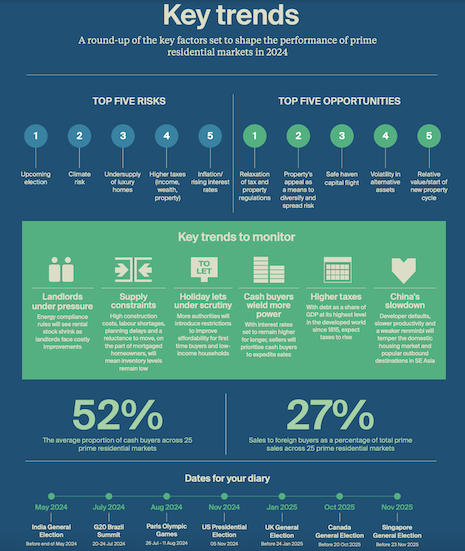

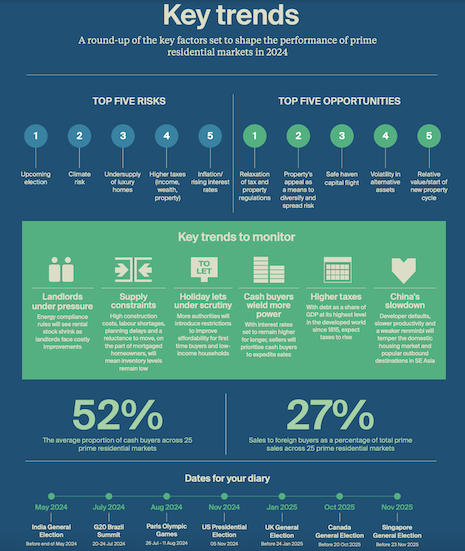

Knight Frank’s global research network reports that 52 percent of prime buyers are now opting for cash purchases, an increase from 46 percent six months ago.

Governments are grappling with mounting challenges, as public debt in the affluent world reaches historic levels relative to GDP, surpassing post-Napoleonic War figures, as reported by The Economist.

The inevitable consequence appears to be rising taxes, with policymakers likely to target property and wealth, per the report.

In the face of these headwinds, Knight Frank’s overall prime price forecast for 2024 has grown from 2.1 percent to 2.5 percent since its mid-2023 global research team assessment.

However, the outlook for 2023 has seen the biggest improvement.

Key trends for 2024. Source: Knight Frank

Key trends for 2024. Source: Knight Frank

Price surge imminent

At the midpoint of the year, Knight Frank researchers projected a 1.7 percent average price increase. However, with just a month remaining, this figure has surged to 2.4 percent.

What drives this positive shift in outlook?

“Some prime buyers appear confident that the worst is now behind us,” Ms. Everett-Allen said in her report.

“On the demand side, with inflation receding and interest rate hikes entering their final chapter, buyer appetite has strengthened in some markets,” she said.

“Meanwhile, on the supply side, we're seeing a reluctance among mortgaged households to move, plus high construction costs, persistent labor shortages and planning delays are collectively contributing to a shortage of new stock entering the market.”

Looking back

A lot has changed since Knight Frank took the pulse of its key city markets in mid-2023.

Singapore has ramped up stamp duty for nonresidents, taking total purchase costs to around 60 percent, Hong Kong has moved in the opposite direction, New Zealand’s change of government may yet mean rules for foreign buyers are relaxed, Los Angeles has introduced a mansion tax, while New York’s authorities opted for a de facto ban on short-term lets.

“Yet, despite the constant policy changes, alongside economic uncertainty and heightened geopolitical risk, prime prices have held up,” Ms. Everett-Allen said in her report.

2023 performance

In Knight Frank’s 2023 rankings, Dubai emerges as the leader, anticipating annual growth of 14 percent over the full 12 months.

Madrid (6.5 percent), Stockholm (5 percent), Seoul (4.5 percent) and Miami (4 percent) round out the top five, per the report. Each city is either rebounding from recent price declines or experiencing robust wealth migration.

“The landscape of slower price growth looms on the horizon, courtesy of the elevated cost of debt,” the report said.

“While persistent inflation poses a potential threat to delicate buyer sentiment, the advent of new property cycles is expected to entice opportunistic buyers. These investors are likely to seize the initiative, exploring new locations and diverse property sectors.”

Some misses

What did Knight Frank get right and get wrong in 2023?

Three cities – Dublin, Edinburgh and Los Angeles – proved more downbeat than Knight Frank expected a year ago.

Higher mortgage costs resulting in weaker sales volumes and a mansion tax in Los Angeles influenced buyer sentiment more than anticipated, per the report.

For 18 markets, Knight Frank’s research teams demonstrated remarkable accuracy, staying within a 2 percent margin – which is not bad given the tumultuous economic and political backdrop this year.

Seoul, Vancouver, Sydney and Madrid wrongfooted Knight Frank, outperforming the firm’s initial expectations.

Domestic buyers dominate in all four cities and in most cases a lack of stock gave prices an extra boost.

“While persistent inflation poses a potential threat to delicate buyer sentiment, the advent of new property cycles is expected to entice opportunistic buyers,” Ms. Everett-Allen said.

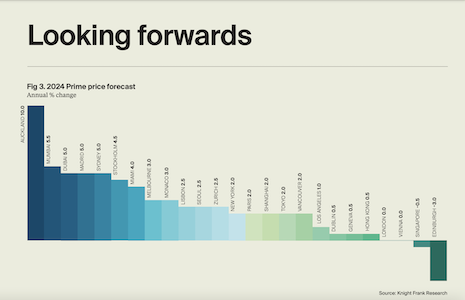

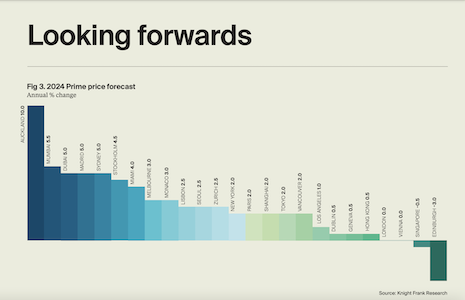

Forecasted potential growth in luxury property prices in key cities worldwide. Source: Knight Frank

Forecasted potential growth in luxury property prices in key cities worldwide. Source: Knight Frank

Looking forward

Among the 25 cities tracked by Knight Frank, Auckland emerges as the front-runner for 2024, anticipating a strong 10 percent increase in luxury prices.

Contextually, this surge is best understood as a market correction, compensating for a previous peak-to-trough dip of 20 percent, per the report.

Dubai, last year’s leading city, claims third spot in 2024 with projected prime price growth of 5 percent.

After its stellar post-pandemic performance, the rate of price growth is slowing, but a scarcity of new prime supply and renewed demand from pivotal markets such as China and India will see Dubai remain in positive figures.

Madrid (5 percent) and Stockholm (4.5 percent) shine as Europe’s highest-ranking cities.

Attracting attention for their combination of good value, low purchase costs, a high quality of life, and no restrictions on overseas buyers, both cities are poised to garner increased interest, per Knight Frank.

Prime central London (0 percent) is poised for a milder correction compared to the broader U.K. market. This resilience is attributed to a higher prevalence of cash sales, particularly within Zone 1, coupled with prices currently sitting 15 percent below their previous peak.

Please click or tap here to download Knight Frank’s Global Prime Residential Forecast for 2024

{"ct":"lU9rEjCmZ6m108bUhW42ZKOhje0yiG\/+JPbnVcRn2+BmhlqKQh6vq43bEjrZwu\/oC4DBwkB2MUxha5Xse+ay\/cmWaZS5D71LJ1DgCaITtPwF79KzKpHguqWpqOXKbvhd2vqTaLu8TcVHENXYjw8aktX00pAaq\/wd4sc0g7IeAqHiGvjZGnsTa9HOec\/RfY6g9MvoalJePUyMdoqOka\/OB+qL2IR\/+KXYs8IgQxFkdv5CtO1arWsEYd3RZQR8IdyrqbYVQMzo1tw+N0pFtgUXKwyr9UM\/kCvRmOsSCC9a8USqKrGGryQGrPVJA1UKVFPaypCJLC58km2+bfaAC61aHfVfUiPWxGqE9U65vhKVz49MgpCn0Gnnptakj21+h6zfhfz\/juc9bcJTO9FczCrCNufmhG+1FYUtECGNxVhG3yA8U\/lA8cKJZonIyaWYmBwhVu90x1WLelcONujNF9X8QtqV0wFjjRmD9x3vTpNvzw\/PT3ivInB992drKEH+j7SxjaoYALeQ+uAE5CZVOgJy8NtYSxVmmEOfyd9kjZL4ZgHmeOa4CxhBzFl8UOlMdDR6zhGToN\/DzezjbuQ3Uss7OfRRjXYEhMqLz2Oci1AbavDntN5fGYm5dNAGcDBpSk4Z\/9HGJVXEU\/B8fHGXZ3c\/sS8ecoM\/VpSYzNNloEn0kOq4n02Eq3PcQ0cdqtuk5aIgMeBN1RQZQOoruKV4MD5M2vS4mPkVJp6w8UOXfhxxucexxkm5Lpso6zCgHTMPzspF1\/AfnziZ4BAu4hsVl2SK+Y1tFg1AIlGb1xNkMgp\/hI+3l7xfXFXE4Ga67MHSvDSx48Sys5yRfjF4u1yxeLEPeX\/tx9MPXITBevQyrB9olmgDdr5cZnv9vLO7vYy\/4C+7sNeAZknDNJHk0I5BQQs2hus3W2+0TQYFpdyOeYc9c9MXprT3hI5AG8CIz25KtVyuvw4iMyi8DFlqjalhr9nwif8bG0ZpeaMW1nJtgUHy74\/YNuC59nPbXd6cz3zt\/4XpXC2msvn52\/vPmGCpPtfCBCj9UOeCvvHPcAAUprh0v0\/H6M12Np45QiSUOo7etzMEYvesIUKpJ0o4GcFUPa4GkcQ\/D16l+0rh+FMoWS6xDgoVtRjlOYEytmz1hdkNR9ha7fNzDGcXmgDUzXvWdqWaiLoM\/eeNYPlfqWx+kTYU0fxBhVgncpltVK+Mx32hnWNLJv38LnLZU2BKe9JeG\/GT2WyLV1wU6BnUuWf0WuVq6egRrNXVwOnwCQBnTN18RjMGb+DBdlgW2U+gPDgZbVe8nOLHQrcxcGg1fuiIWsBsGFfDf2XClniJ3hxLOlCuIF5FUeUS3VBv2RvMa60YUa4r2ykvaBYPplDaGQPFz8A2XnGo\/bWZfd\/l5AbWhf\/AYUDZ5O\/x7mYuNEgAHWLmm34\/P4U8c2NsGyFAwxfMo7zFEoLAnuMduhFTuVXrrj\/4k4I9y4ksKLAXLWOvj\/AFo9Xj4aD5CANd3FyG+0lrglAcdWDvbKk6qiMxrJRvJQaGeUh04eqcKfS+qykPWWiQVgPN5Lt8hUO5nbrgU6JUycOCzBr2u1noJiR8g2A\/QJuYOSdtKSqmExrUVTy9sI0uQm3xR\/G3Uumi6FT9QjSwhM\/dNrpn2u5afW\/TJltj9pqqdFHckIIgkKD\/PRsUckzIoFFy4weFJMDxD5vUdI0cxWelBZAWBhUreeZ1sg3QZ\/ZXPH5OKo8IJHJEVdFOsza5dNEWfrpjSpN5erCfdd6r6ESrIQnsq3SLnzHKy0prd50F6hFmA0vztYyo3F+vzg54y3daUhEW9lh2XUu01DVvnGhL7We5VEHYaDcHGUEO1rpVpy16F95y6J5HVx+4lcgnHTIjihcf0R9JZM9poccHt4UNWqcUECLo\/\/zSPhEcYOtzUiIzvjqcpEJkDUSnI\/WimRqjYfQ8Y6ZEsZlngx6dzpat\/62\/363QvWcmihCea6zF0JOb66T1SPFjeK5scew8yoRJVc7tMMkRuklp7EqZTyE+oBmJkZ4\/m1U9GMecUUWadkniYb6OTDafMgM4HgPLaCrB8+4Ig6rxNFMZfnRsJMjcAkgho4qguBMD8dCk9GJsnGl4ZzIF2nW0ep1Lap87DAL6gLwjtWyKrk\/ggF+aZXk0ZK+zqfP1UGZRW4MxcGHul8mxq1j46B9RCYV84jj+igRXqBNZ\/yvyg0uNdtdoH\/thV2H8reS36APS2lyQfBVcIcpYYXV\/hNBk5UL68mXvo3FtfgxCfCZEL1FjSUnumIbT4cFO0nlF7inmIEtDT1wFCLKd+O+O8Y0ui6QAoJO9MlnL26H\/KcIRR3vF0SXTFiAjdEiH42jtw\/M1G9DyAG9ycPo6uPqqUUPwovMqeg+eq6KA2x2EKj7yGrOLI5VcWlYqrUkXyuVRpkPJaMiQ5GC5\/54Rr6r+r8dqpI4HfhLVPUIzX43WOxWwbMC5FYsOSnYYCsJVBRwyF0d+aN0R1wgDGkpxVNJ3ena8xnwXc0N78qz2Hhj3XRuOciqnRWy0aXhwiJE\/1NQADiA+1TMq6+Okojz2YHNCCIvcFtY+ylhieekSFzawaCKgELp3PKY\/uLDp5uCVwISSq45b0Ztl6HajnssDePEN19ZaA2m\/\/jG9CzFNTnIvbVhZZOVszAP1rjL3sBBLBWpJe8sfAsUZXot5cr2VmulSApBFeJgSLBqs06ziTyG9DulhvwRUNcEFwKj9Avzn8iSsTYNmpjfIgbxKajaLOq4lvFZWtOWALlOBSQ9HzQmaWzsM3Y5zsPt5eDXKshVxcFmwlTKeM\/e4JJCaEE\/mMzalmbgqsJc9fTazgiTcyVnjmDaehSD8ocLYB43aK10Gg6wQbGEE56c51onA9hLPpra0Nho53YZ6NpEsREX1UIPhV1Ot0\/NWn14msjzWUX4pEPPTKa7wXHaohax6I0BYs+ap\/sEZWFtQmANiwg5IPc94+46PHTC0T4SOEYSDrJoHY2evUyxw8ssZcv\/LuIp8pqBKNUsNAEYaMO61jOJknMTC8OHanuaFTSFdkfQttTNbV\/xDfj\/JGQuVMWuPswwZOafcBocj6RRKVCR3WK+iMY2\/S7KAj46r2z6Ouc2sNmL0ffcDwN1ysugrYJjLrfLs0PaGo272721O0\/hjtrImy+bJSGejvSIIHgGaT9eGA9Jb2zSuCxSpy39eajudYuIiehF7ZUbt2sSdXDjxw+uOCE8mUPEioLw1jcEEfByqmib8Zh4nbgyU8uoK7F16NazhXbdYA04gyMGMCxCwYX2d2dgq25aYy2y+8ZD7LN+Llec74ry3lCrUIiGJa8b5aC4mBqMViVZryMUYw1CX7ODK0IKe7YzohphPlpQC0IVGmr59MH6D0XZLCRZnw\/JsZuyXdPgqrgg0gAE6kWZMzioBZ\/EgwGcyAOsDyBRZq4CoH5xg0p4XccoXWIb61XgnEdqTSkL2RZfKexWi1bgeGBC\/gFwJXtmQSpC74im9R9xCIhaw8mhATL9ZhLgYZhXDPsGbiFMHvMCsIqbytdNuHRMvmHeW0lVac2WFB2hGN67d9vom+wyfeVNqS2iltoKOKYG4VqsdFi9C7jt+IElPQJd\/d17GnRz0eY48PzKujSQ0GqUr1TUAeqHXu8tE\/Uv+hMRT\/G2Ni9PEIOvFz58z\/WFF795IpEfxDjfoKFZuTv+AunHMT1sahUqkBX0p\/m3ZcTD3cCYaATNTjbgd1FwPQE2EbAFDKRKCR14XODKoJDLSFTKKIOCOQmCildbmP+nc3OGExsrzkCE9s4F3TExKCKjG09T6mAstcq2mKZE8QqPZ3jGLqlHeQ4m+k38lxwbCs2vhdkmsLXvMzLMI1ubqsXBO+CpZkcrVqYBo2FMnyXhdx\/GdfIrAchdtDKhc32Mx\/AjxIwTPk0U1Xwd8Hyxs5WwIP0N5todT+nzYF3Ja7oQYhOkSV\/FY2RzVOrLA+yR5xLlT\/m\/ZT3HTfYsG7JR1xz\/mOz\/ftfR8BqR+ybNen04cZ+7mu42mpUrBjDQS\/h8uRbovX62er0L30ejppiVtBSdEasdNm2dFmL6rn9mLaWhD8aySre5D1JRlTkHzLP6KhfZLMpv8cneyhvo0LHbMT8fpUsDiKJAKJHe3LfuXl2AKRMEP2Hxo64q6dgJBVGsf2hmeZHb3rNB5ohHQlOCZlMTnkjbDhLzlpkVuNsfgy5AbQeiSbre2+\/UydmvFk9oJyZdG\/loa0edYuAQ9MdN+4c+wrIZsGoGyAnC3\/nr0aXtMxk0JlHbf7wo1BFA\/b87KIlSte+nQtXm6A0oH\/TWVInpdZGsb3KyyCv0vOO4CHkuX\/oMwKQziR46lNAncSrZMBRvFh7C+9aCkYqp4FTShVf5suyhUHMFE2iGtOBLo\/09FJ28C93GkJ2t9SkFbQePNW1rG0v37I0yGK5Sq+9cYFsNmWtHayoiMNUrOxtUn+JEmWdgQZtk50MU0cX2LKO9et6avFkmdPOmmTT1kBx7wo83Ff0H1lnu4pyCrhZDl7\/7Vk7urXEEAggEKt1VPD8lu0HBLZkAt1vInSp2E403sbxlmZ0g5rCps3fnyImoEGx5\/s\/NQ1cFG2gH8elBImZh0sW4Af+ziH+jmPpKho6Vu8RhTaWDt6q1edrbBb6t7eHuFJag0sh4KtrY9Gc94DE73mE0QqesApJ2bDYtG4jwFQ6oOLT5UbI2pj7ZMGW6X5Lbs5J1nLqyddZai4hAvNugPU0XRlKw2UnWNtk6oME\/fQytxQyD98TV2hv2f584RBP27WI1amPRGLgHqaqclPM9v1eSEHgdox4R238fJXgv0el2WUTuFGxXuI1v7jiqhR0TztHJnK+4G7\/bDwN\/RBzRIqJEtspmjWq2k95DtvmINiiWy\/heQRktHzSNDGgzGSgcuYKd6fOtO1m5EIF+64b1me8PifmfW5I100sAbIxX4Hwsf7qXhYzcPezPC7Rd5yqhgMo3HRCc9upJshOKQKKMbDlcaGciaEFPtQ8cKs0ODcL4uEU5yn1NwitjTczSw9oDjs6DyyiinSW97l\/ppL4UueWKWFQcQlXJxoWoUSPuZeujmR74Fa9tqFOdxX7dMmwRlSerQA6xv5vy35QFswwmNR1EdYxDtDr8pM9zDT\/rIhykRRzC7vbBUszPHgrOAQBodwNUEN+cWXVz8SiV+1tM3c+dqP0ayZuHPTdPVWDwUSrPCsHMITlL1mU2pKi6zadorYjfUaM0SVWxkkxp8IuZZaJFxZ6y8gUGW53e7vaL2lRaL0bmZX5oNZxx3VHwGLT\/KYAeYhQ3qxiUSftcCXt778sx\/\/fYb58tlAZq6mC1wE4hPUccBF9814FIuEBExVFtus7VJrPN8fXe\/0PhgqXJnP5dLjzCmKwTjd4M4A2YXmve1vbeq99c2p5zYOWmucR\/PvrYQqyc9uF8iZ3d\/beTp1f77Pr2Swj2dQqOrkNRZ9Y5dChw\/J65epCGis8LcUW82xNHuhlLHb9uCi1Chd6DicDeZSNRg+A9ONIJTOz0PhQ26cr9ZURDKMmc7m3ddwZ48PVSIbZ2PvuDQHhjYVooOaQ6AmHHtSnSKrhV7Bd+960tKa3bbxeOTTjm1p5jMl++WHGI6HQnjcBIO1Ff3nYUhhzLFUJDVlesnTgSkaVhVWOJzlVb0Y1DgQy+TdT2kPLKnwPDnD8X+wPSTEce\/zFqjIU5NsSs9wSSeQRGJVuxoNzxCJW\/GyPQPeMt40\/tHCD\/fmh5mnMChcZOmul9StyAFReYKr2mLCu7TNYhcqTC6qYRczg9DxCFWkA1250u9GGTp7KjkhgUyimeuy6MngurUr7xH+NYdKWDx38Zu4segMUOvDvp8iG\/eKnA5lH00e1ePWNpZ9P21dwhrVv8nJ0dW3y3Zhmw8kSh\/6+gcUEkeXIutGNl1TiQVEW0jNF0gFoaXH7WhxxjiXe843+jFAXiu+y0O+84JK6tK0uVn0N\/NDfFDIWPEdLbfOHjmg4suZNt8QoY64uIygSl1N0yDg5CYz7\/enHk+yLbRq4l9dYSWltmdxgAyI5vXb2ztKLFMxbEoznsoU6c+Ov9AljpOiw85u5YtXRr4SGQCD7K2jsG89iz8hBaDl9ZSrlOL3KmvJIpp5m3McrjyvbaBy7Czcel7Lhi27oTpyPgsOZxcy\/rUlGC25M35cPbMX2BvP4a808QqfiM7kg9sDj8saUWixdrQYF0f5Ch5SyJB2xIurYTCGU8UnpWv91UmYyWphtPlN80ZDswKfNIfpI\/1cPJKDzcu6\/NyW9fvfTCcYE\/Srrsl0Ts6dc\/o2Ay83Cl1r8kKSrXOULUkQnPZLeDAa6700rUorj1M2P+oClBV3GwcN\/4lu6+0cQVeIyWqEMmMapliM5WdO1q8QBIYgB4Tk2p7yZ4\/JY5i9\/GaEmUMeEXk\/6ImbDxF5krFbLERvc67xIiZ8hdkszGiACM3lpld1tQO\/5nYVXTVBIEZccnA+8Fdp5Au11EfUIYdC\/wOKlGnTK2MnW82DE3TTrNWiQ3TIPpgA\/gKcF4+22r\/oSreMskOFkRNo04Ln5ztFKU7bdxOafqtebAbtZyJwsw+R\/G63A7RNwx0C+lAwmtj6PkUFGs7srOaUIvspx0tP2HUEhNztthLzUzh5WqHCO+CN+\/aMHWJMl7zSl7oTCCEe8pNL9syhUEgoD7kDqSSRwTAtC2THvoj497ag2mbZHidgHy3w1FEYnbKepGoBgJc9R8CisLa6cS923OgUy7VFNWWdf5hBoKJvo43LXFbkA5ixOxTlZcPKZnXpSPn7xoHX1Uhz4wixZb+8UCZhfyWywQkN1kXuHkwpsBDh3+jWsfo5UHYJ37mvf1YW8rUNLT4mgUHjEMxeEVG\/Cfn4n8waWzRYkcZzxU7Ckffc30eLawdHrdgLCjtGouWTv1DLdSbkCdQa+\/XL5XC2j3PLX4MsbD3Vj0UPpqPzsFZkJOkqWr\/aQQaznbMt3VwhmQvF3ZYPminAG0t0iuxTHxDltvjvhJTjKw6zMyPGCANX7MMq0qUAgn2uQjeDYxcu+b8seJX+2q00O3ofq5IhhVzkA5rDOIUOQ3wxijgnCoova2wJkuQyCjNWYNBKKcHi7Uffx\/TqWvZMAwoVOY4DLiIzBfy0dz95rpIfntdYKLMzFVUqxdEQSIiBQF9A3fq3fV1jvmGs8tFu6Fl3E8BLGSuQ+49jWK\/YtCiVhK6BXi8hG2LokJf6nYlrLICkKVu23IIRFf09Bbwrzb07\/htb0F\/FmkEJwePtkwCQZTkgCnpcIUINqqe87nY5E7O0TdtobXhrYP3mWaLCW7WEDUujLLUBrDI5hLyrk6vE0nKohgoIoV4oTA3U2DnFpKl\/8Wovvc2PrUu\/Hxuso3kJmfpM3kcqqchKSlfs6hq\/1T+9joGYQoFangxzliuQMd7IG6XV5zYW2i8F63ZyHByo7BufEPAkyjHbLcXAnoU8foLZ9jYkWB6nFvzToflDmcck5F3sl6y5\/LPmCSWUpMSoAQ3aw4GGrveF411XcVtPT0PnNf7Z1ioyAbf7sJAHeapx59qzZFd1oj9NfAg66IVB3plBG\/S5dAH9+FS4TXIS6nRERtmW\/q+qlsOlQbNFaIChc44JTSNGXdLzsvyMw+\/8X880eWdUwgmuzE0UcRPqQD43Nht74QnZHToTMoEY8wxaPoABwypY+I2Mj0u0fTPmGNksbic8HVLLKBn2ateEKdBFa8KI8hITpQ+TDdSeNu+q\/RLvXgdjayHUya2iVZd5I3Z3xQpcM3AK3FnWxR\/8R+VOIOV5VmDDRd0ulqVE\/zl5jJjDlV56n+Z6cG314gmqo99NS2l4OllvwBpex7eM\/j0xyuhsqxxNnxWFmmWC1sCCjP6UQZ+mklI3hSabW3Phswiohk96Sf2QjRFugtJEV98tzgYCkdUU0bnKBmwK8eLTSKIuasoG0S08VWpFeidptW3Ja79E\/yHoxoudvWPmk7sPEDGR\/VMTtA6euAyXmU5vJtfzbGf2a5AeGVNHAJ+3WJzy7z\/cQnSq7Z9YBoEt5OLXjS2ZvI4NX4c8Qlzi1XDfSljmDK+FTKZJwcUXtXaGTn442EA8tFLBMOlyZEiJsuRu6J75tur8rWZ0843b1EYtNZVa1QrZYTcKwzNJp6uk66xJI1fLx+uxZ\/FNirH7DTbfPWO98eWMvoegQrzCkVX8ZHtCrgJZqFxgrgXV6DO2scR1b8cnGwj4cdllnq+lKGo+rPyxBu2NUX7LO7lw9QK55WWs74GL0h6MXzHfqRcL9JHZmGAkl0wmZhWWWezk+09r258RMYByeyvc0maX9FGyUM2uzNWnkwKq09A\/EFmMLvaTZIUBAFU41Lt\/Y4Uc8qMAoE5sVG1qMhBGdt\/miebWaLikR573mEjLHphSbcrrFOaqCSHzqjxCW0saojwxUHMvZFZlRgAVQRtJwDP5ys+pTRfj+a6LA9\/f5BQf1uSb01uV4xhKcTqS9YXd\/wIgPbS0T6bsiKjLGnVuljqj1Xt0eD3zUFPwU63Ybr5609TCRFDsDb0hirj+tJuvABiOBZW2dYCxN9zcn6HibwJtpQCJPW8a62G7wfm3dA+Ui1m5mUD9hdDcDGOG9RrJxxJ6cGCywQ\/9OCfGKbM3Vql03DMiRZxKudbXlOYVWoFhmZRsoriBDtBTJtho1xd81zS214V5bqPWAnq6xs8GwTb51nTsAkNkgaNynIKEmRCYRH0IibktbLyyd4p+IWooJdpTdTKB33fM4hMpCOkhpzahFRjkE99O5o22SwUdlPs24VWFvSbgEJUMLNEJhyEfzh9OygT7QbfWR\/8gq9khBizZAX\/WxS1\/YcxQCb8YT2GdVesndc0I4xtVA0ctxYwOamOAq3GldXQcjZLO+MaY2pTi0uJZWGWZWXYR09mwi97PIGjXDJBOZtkq5\/tfRf3jmiWhYQ+hSUY4OlUy7idKgB1WN7fR4RnC1j9DBnyhQmQnCh2PVO1BXPYLL6INsHBeTI0EjXM9oZczJYWir8Av7dtQLyZOxHIFd4G+6Y37Fb+51JXMe+PoO3n22izmWShgulcvbk9u\/5cSDuKLB6Q79EFUZJBurqZZS\/CJME0g6clMALxTSmZvSb4yws03GlXWRwiXOW\/JVwbgnzZeUxTRI8wt6u5tppjfX6z0BIhLbuTEWh9p7FC6\/pB4+ByRcJjY7QCtlTnta8WPd+z1ivsJVOcbUWpVjBN8RQMmVvsVk0Vpp8Ag2X8iIXBpfuepiSgUf2AY9tDY9NdXQGWNyBqdcVrRAZOUMitGpp1QyxGVdwmAXo6n3UywE\/YoWgsSVT\/0Vo9jzQgMADSRNP4xfYQu7v1rOQnNmVD4IwPGSObfFqhtguX\/P9AJPYA7378Jrvk4PlA5e0DOSP1isj5WegkKJnjXHznv3qbjOrADQZAXGWUTbkiJ3dfnhkLVYiX8xrLUiZDxctfrwqWcr9eOoNtO5KAJhy8qpzL6\/ogzmYTCYcQMhdvwptOQ7b9\/lVUeW9Fp\/5A8Ge35ar5CH8h4Ke7zTxSDjsy7W5RbGKwlcMHCpR22FPy5bXOMG4itbvC5gO\/pkR7it5m0k2fOR2h4zYKt+cn1Lc9bYRclk6X4OA6HASo4DU3x6ls\/y\/lnowOs1pGE1cit2jyVut5Y1paIzYPzieR4M7av0rYrXnNZD7I3abYmtCY3kPn+FtKPqp6hG3WCl8ak\/zqD0vtnDReio\/5qX+lUZ76onsVoJOcU8zKhIKteOD13UQ9EDEBEBN50CHjlsXDNrewmYY0s4gL39eg8uUldZN9dSqtPXu6eUYcYVw1bq4bf4K4u5vSDmmizYo4kxKWO+6IKu96r8Jea76oJ8LZH5xBI5mfPioD6eaxiZfSHGyha15e8Z+\/e+3OOsCCjOSlKBhrQ6f9BAfxKEiSo9aQG5CfOES7MKqF3ehBnPKnW6CS\/qYaRgaRSSGbR\/wEx4MSSGKPuwPE1kptSbZ1aceLGQ9J9jJBMMbMY0+efJL8ZNLxn6kznv4WFyDGdSgq\/CHhqq6kCHVZkdeBpvDp4PwiJfB5tLgSFkU0PZQOcVuF9stI9UNLy+3VPserziqiMucK\/3npVtikE4XTg3ENWF7xsggKZIovI8gaE2BgUSkZsDpNoPLojtG9rHCNA1fgWV4qA8axxmoKrZHnjQ9WeTLNEW5Zxksa\/HJl7IjudO2Xi8xUe6L4O+rReE2SYxnisY4ypEg7RI36adwcVXSLBkSWSKBnD2ZlX480s5PIchRLrAQA\/Tjw9yL4hgqpZUuKB8krBZhEiDDeS9QwbE1jKsqxieBHmY946nv8De\/P2GSoWL3xxsp3DH2UUaWL+HbRc4MZbjd310p946kQLg3l40GwSCDrcIA8OibNJ29prQLfFUJ4TYTgDXMa42o4aFk9GgexOIulpTWr7fM6hmKOG\/xBHB7XkWPqVeRyuBHzBuD\/OGn7JjZmkGYx9dpl0rAr3MiUv4qNSMnWBO5smePSX8LhwLTXMKujt2\/+YH2LYJMK\/PN7KbEbKY5miREhgtPcNPRZLj7S+qAQEJNlVrV0\/tOF+oAo43PJ03SmAEuklmcniWwf6Mjh5SM0sMmjl9nQ8kJL7FH7reEg6C97DAys\/BKkKNbHaPSZnfV4n8f\/RvODqJWo3wUYTZxr+LAQT+wX5YDWDdXW08EN+D7LGs\/f3OcbHJeT7bk\/BXvbzEDYfic5EuDCDHgmCd9MDviupAGfZ7RakFmqJu8IgF9F1Jc7N\/bZnJ1BsdJexuYh","iv":"e5233bf23b4a0cf2ec8a7f21e923ab76","s":"43e6308667c75615"}

Key trends for 2024. Source: Knight Frank

Key trends for 2024. Source: Knight Frank Forecasted potential growth in luxury property prices in key cities worldwide. Source: Knight Frank

Forecasted potential growth in luxury property prices in key cities worldwide. Source: Knight Frank