It may be a mixed bag next year for the luxury housing outlook in key global cities after many returned to growth in 2024.

In this assessment, Liam Bailey, Knight Frank global head of research, outlines how the real estate firm anticipates key cities performing in 2025.

Here is the outlook, in his own words:

This year, many prime housing markets returned to growth after prices retreated in 2023.

With rates on their way down, albeit slowly, the outlook for 2025 anticipates further growth, led by Dubai, New York, Geneva and Paris.

However, with affordability still tight and inventory levels rising, several key markets are facing a standstill in prices, with one or two at risk of a decline.

Dubai, +5 percent

With limited luxury supply and a rapidly growing population, Dubai’s prime real estate market will see positive growth in 2025.

Listings in prime neighborhoods have fallen by 52 percent over the past 12 months.

The shortage is even more pronounced in the $10 million-plus segment, where available properties have dropped by 65 percent.

New York, +3 percent

Following five years of sub-par growth, prime New York has regained its confidence, and a truly positive market expansion – absent since 2019 – is set to return in 2025.

Inventory levels remain sharply below the five-year average (-54 percent), which will help support pricing as the selling season gathers pace in the spring.

Geneva, +3 percent

Geneva’s 3 percent growth forecast reflects its continued status as a safe haven for global elites.

With a strong currency, low taxes and an excellent quality of life, the city remains a favorite among UHNWIs.

A planned income tax cut in 2025 in the Canton of Geneva will further bolster its appeal.

Paris, +2.5 percent

Despite political instability, Paris is drawing increasing interest from United Kingdom and United States buyers, driven by a weak euro.

Buyers are eager to move forward, having put their plans on hold for several years, following the 2024 Olympics and France’s general election.

London, +2 percent

We expect a slower recovery in the short term as the non-domicile tax status ends and stamp duty for second homes is hiked.

However, the relative value since the last peak, greater political certainty, a high presence of cash buyers and rising levels of global wealth mean we expect price growth to strengthen over the next five years.

Sydney, +1 percent

Price growth is likely to further moderate in 2025.

Slower activity will be incited by a federal election, ongoing geopolitical uncertainty and any reduction to interest rates unlikely until the second half of the year.

Although underlying this, the stock market is buoyant, properties remain tightly held, and there is still depth in cash buyers seeking downsized homes.

Miami, 0 percent

After experiencing substantial growth – prices rose by 84 percent over the past five years – the prime Miami market is set to relax in 2025.

Annual growth slowed to 3.8 percent at the end of 2024, and we anticipate this slowing trend continuing into next year.

With listing volumes up 36 percent over the last 12 months, market power is shifting from sellers to buyers.

That said, anyone who purchased only a few years ago and is now selling will still have done very well.

Hong Kong, 0 percent

With the relaxation of the New Capital Investment Entrant Scheme to cover the residential sector, we expect the residential market of HK$50 million-plus to be more active.

While mortgage rates remain at a relatively high level compared with the rental yield, its scarcity in supply and attractive pricing will entice potential investors to re-enter the market.

Singapore, 0 percent

2025 will see buyers grow in confidence as rates fall.

However, exuberance will be held in check by the prevailing Additional Buyer’s Stamp Duty (ABSD) rates for both local and foreign homebuyers, especially for investors not purchasing for owner-occupation.

As such, price movement is expected to be relatively flat in 2025.

Los Angeles (Beverly Hills and adjacent areas), -2 percent

Prices rose by 52 percent in prime Los Angeles over the past five years, and after a final flurry of growth in late 2023 and early 2024, price growth is slowing as inventory levels increase.

While prices are likely to be down overall, expect some record sales for truly best-in-class properties. Some buyers will still pay to access unique opportunities.

How will other key European cities perform?

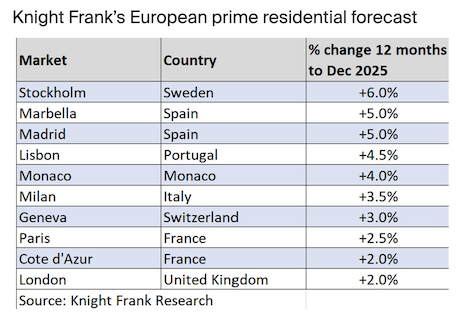

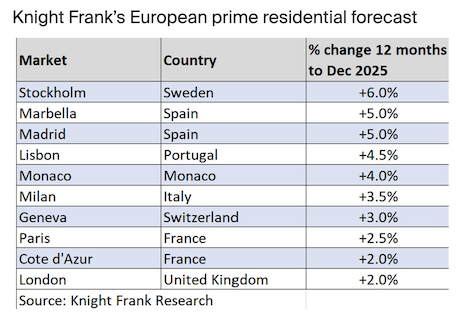

Which city tops Knight Frank’s European prime residential forecast for 2025?

Kate Everett-Allen, head of European Residential Research at Knight Frank, outlines how key cities and resorts across Europe are poised to perform in 2025.

In Ms. Everett-Allen’s words:

As we look ahead to 2025, the prime residential markets across key European cities and luxury resorts are set to see different levels of price growth, although all of the 10 markets tracked will register price growth.

Leading the charge is Stockholm, which Knight Frank predicts will see a 6 percent price growth over the next 12 months.

Having experienced a 13 percent decline from its June 2022 peak, the Swedish capital is now poised for recovery.

The Riksbank’s recent interest rate cuts, four in six months, have slashed the policy rate from 4 percent to 2.75 percent, improving market sentiment.

Knight Frank's European prime residential forecast for 2025

Knight Frank's European prime residential forecast for 2025

Southern Europe: A post-pandemic oasis

Following Stockholm is the Iberian trio of Marbella (5 percent), Madrid (5 percent) and Lisbon (4.5 percent).

These southern European markets are thriving thanks to several factors.

The International Monetary Fund expects the region’s economies to outshine many in the Eurozone, while prime buyers continue to seek lifestyle enhancements post-pandemic.

From hybrid work opportunities to sunny climates and top-tier international schools, these destinations are ticking all the right boxes for global investors and relocators.

Monaco: The ultra-wealthy’s safe haven

In fifth place, Monaco is set to achieve 4 percent price growth in 2025.

The city-state’s limited supply underpins its price resilience, while its low-tax environment increasingly attracts ultra-high-net-worth individuals (UHNWIs) as global fiscal pressures push taxes higher elsewhere.

Italy’s rising appeal

Milan secures sixth place with a projected 3.5 percent growth.

The Italian city’s allure lies in its appeal to UHNWIs leveraging Italy’s flat-tax regime.

Despite an August increase in the annual levy from €100,000 to €200,000, the market remains robust.

Additionally, the upcoming changes to the U.K.’s non-domicile tax regime in April 2025 could drive more relocation purchases, with many buyers also opting for second homes in the nearby Italian lakes.

Geneva: A safe-haven stronghold

Geneva’s 3 percent growth forecast reflects its continued status as a safe haven for global elites.

With a strong currency, low taxes and excellent quality of life, the city remains a favorite among UHNWIs.

A planned income tax cut in 2025 in the Canton of Geneva will further bolster its appeal.

Paris: Resilience amid turmoil

Despite political instability, Paris is drawing increasing interest from U.K. and U.S. buyers, driven by a weak euro.

Buyers are eager to move forward having put their plans on hold for several years following the 2024 Olympics and France’s general election.

London: Slow but steady recovery

Although London sits at the bottom of the forecast with a projected 2 percent growth, this would mark its best performance since 2014.

According to Knight Frank’s Tom Bill, the U.K. budget in October narrowed expectations for prime central London from 3 percent to 2 percent.

Changes in tax policies for overseas investors and entrepreneurs, coupled with higher stamp duties on second homes, are tempering the city’s recovery.

Europe’s overall outlook

Europe faces notable challenges: sluggish economic growth, political uncertainties in France and Germany, and potential U.S. tariffs.

Yet, its transparent property markets, excellent accessibility, high quality of life and world-class schools will continue to attract global wealth in 2025.

{"ct":"bYg7KaWPxgDoFAG4knH+L1Bygx6GUVM4Sm0s4X+0NYimdUy\/XEzQHW3EhzwmjEhAuOZyxr+K5GlnI2Jc3sjhtbfMsom79qEA4g5t3Dq+5NQ+4mSudYwGhQ0mulnrTa\/bWt58nVraYwyDakV9q\/M1QTdl26Vs8ef5tb3R25Ju5V6Q2daWLEQ8D8UYRYQ+ai2W+TFePv0SbnucQpdJba6H8uJahghoK7carOmtw1s+M8lL2h49Xoe0a4eLhi\/BRfVYv5VYXznuc5H+79DpiXzr5VjnMJ4aIPgm3KgRTm5zyuWopyawJh6EdYwNvzpjqSfm\/2KZClD44edgX5B08HXIoVJqETnUUHOI9cahcLDual5tR2tjsmqJtMwr4RUF7omCgSOR+eZFG7+6hcKRpH8jPbjg4XfXMxwOdfI0qToiXNjNluB2CKdyvUcCIesEDuuqUFptnf22jbw\/IeTjy\/HYV\/ChoQUHa\/ntFjNGaOeUUx00eZwPNOeJshi14juL8exrr13te23qlsBkFtuEQL\/yBMDPiaCyZfNid3XkVHfsj8nskNYETg3\/TaIftaTo0StoK8WZh5cXw4QxgRpHidvDDzfRQQYrz7RrLz7rjqNdApIfCYkJnrsG4hJzFr0mQWf6AhbEJXF1vNOfkGqqVIFQsYXi3AGKn2jS1XmmqoS2jFknBYoBUElCkLgfG61h08JJ2h9BJzWaPK8hrdUKvTFcYXPKib+LJxbkmfP4KI9PP4j4S8raIFnjynHDSsOimYAgSQhikJdOFlBWJY5k3urUfWTP964n\/+pKrdEET9Xyldi9fdLNBIkKxBRE3zSkMm0Zfb01kPMj\/gxDXE0hcXNOJmusWFiJW4qGOVDFXCbi5MbRifpGN2idlFVX4rJ6+57jGaSYU647\/uCmu+u3MYQk37Kt9eIbzYoMYZlG51yZx1DnaOpHJsmoSEPDCeKasTO2AmfQRT9TsjVl8GXV7eenBiwMo4Uh+BuO\/QJfEO+7hHH5d3hBhEkoi5PekAasl9tV0R\/fbLNg7Z\/Av18KQp+0rEXGMCDBimr09DU8\/Q9SsM96VbjzxJFSdHmve\/qWRYH0h4qrbziRlVjPBnqmZF4m0PL4Y8GtCY\/CwxKl1nlFhlii7XdIZJ1fb4b1Jk7XNYFBKdPxlR8+org0vw8WV59LIdfBjXYgVCwceP4Vih6+vNI+LXd9s1Bbz8z0vY9vARHAYrYXlU3Oy2XmuhN3JqJe+5xxeQ6Kfn8mg3bJRxxv3iTApwEcqBhlEdxsjirbPG\/iqWp6k8PUa8SVwBLYp9nZmH2whFxuvO3iVgj8XQOYsdu8\/k\/tIf4TMCFoopCDPSZ4dsngjvw0O9QgDEzBDLnNKpak5B4FSp9oy9\/rMClC9OnDKw\/dhJR+wlGhz0nW\/rxVe9R1+pCuzUrG0HjUox3E3Gx2NcZMk8ZXZX62h7Z7JvmG0YGQHL1o\/vvJ134wnZIBGKryAkdmXZM7NJ8bNbbbtEFhKZtMJXLoaEf8yE18SmV96ffkEOds9YBeeAC0ZGmPPVem7MlQ4j9H+QzsmlwqKuADGtZXTQVGvnuJ4ZM63QFAr5OxoMUVZimIHnQk5HNAu9c2L+kQ8hGviUCZDUdTlwMRsbdOVjb+Nu4feFE9Ba3S4O2MbXFW+gLRuiEaJO6IWm+gHMtshnFGwEvwFD7B2tyJdpUcuCEFsoAbQrHUOUlFgBp77jISEf5t8GzwctLYlFAPzOAd\/BuIVOHq4ur9ndkntc7BDoLROJiC4zz1jLSLZ2tSV484yO4b\/gVk9LzRvNDsfnNP9qV7gD7uN7eUPs3m+pXaAkIT\/N86ePfrCQ4RrGtzYlnz0ibkBRsEUWSSL9aVO9QyAKX4083ugdNjs2QFvECtBmeZTzBXfIhArE1LCC3FQgC6Pqb\/414Roc9OkD3\/kT4uXgF98\/kixIyazYFkaZOKACze6wuzQeKnA07ueiBRu9VSYq5IzTGupKYpDAl5c3xciCQ6LonTtSVHM+JLWGth9Ku7Q8mxNvxCIgnFONL8mIE2Dgfhn0VI2XYH0DX3YQoKp1Q377EG5VH7pL9cQltISha\/XVTejcnxOuBdYTWcITqk+eJM5L01srnw\/NqAWDJ+n5em3G08veqwevJXlAI1yceyL7aImI+6XbAoGUw2W9ZX6bI6d\/VzKPlrahK1uLzaj0sfWPxTGpARbbDKIDYoqyB78BVotg0qKEeCFKMJvFP2Q5zPNP6VRYCCq6VsVjjFOmHnFmH1aCsH3Q0oTuQmFN\/xnB\/7\/TFIeNirMDcNkDwes9f6Fq55o6KCvwl8wzN5jgchIR3GfXwhA8endNrHOLcQKCqxfe9lAWCm54DbNCN\/wGjOmAkdoxdsn2KkOhcJnY+gCOPE6levCBRRJJ+8sD+QHr0PAQGQmmAMbinL4lV+1bv+C\/wI5PB64hN0at4tTGLkPMNBsHxQQ9UdzE+cGovzGK1evqMVBIrtiJhsRcG5TqFDg6NugYt6Bo5X91OG5OvpVm9lxtqx2U\/CDSHZpxsfLKjQbf88337dezJZ92hrqE\/FF6F67iI+bZNWG7nAW\/3L84DcfUbC5YjALvp+um60E98elaA7leQ5d9UsDRjVboQ98pR51d+U7JDa04VuuvJoPXPinRSgVuQu2wPaXpK6L+ZAvZvNgR3TpxqGp5ZHNvHANvHFVVrKbxkH9ucCmgjEubt01cXbjM6iGh6ukyv0F+nc0gkm+5YdYb3aPaBcHFebTdCMbyCdweNO9K78\/8KYzbCM04JjC6ba9A968n1MRlBubg71p9dDkjr+v74KojQ3g43sThs6yBt7+iyDSTxrslgdAx1wQJ9Lffizoinc1QAcPrYugT4OueQ\/5+8Pk5XoWyxsKg3WnI0fwqMJ5u1tEUF+yenEWq2TPgQiU1vdc0Dm0Tv\/MVkbzreIgmDLof2XKxVk5JC1nzHJS6INEQOVRuI6Ehdq+wydNKUiWbLO96WMvtFgcKxeb+kgpn+1GDM26oBTEsHqVhVXsAYzA3cN5WZsgPyNRFvxYTUxOx4XHO291kumlotg\/pt8P8AWKe34eymY4rD\/bcec0C+zlSy6afrjlU45hyBd0\/\/B6xszERUWTxfj8EiKQ2WpjNrSxnbeiAJG4ZqoDhi6vYY63wOK55N1GfstTL\/YRm3swHqCq5IvCNSuSMZnX\/siIboRpOZrc2WEx9LAAMqfeHEpwht1Ktxef+Kfeky8753dP23pY\/el9L0lE6Zfm7MmUsXGJCsooiatwNSIZ6\/xXran\/ON6VhN9HgM1FudpnD3sOLu2iFWJmNHDRmxENLgOxRVRTAhFYVAzJISn\/\/eyE9Z7ldGXG3ysEDbiGXMy88IorLK1Kt8j32fUyTpB17d\/OaIN5takWn3r\/Qhj\/GWXEKOgxTOA75LUYFmkXsR16\/n5XUCNsdco0a+o+N4SZIdru42VBxzpGRUSaZAq\/Qj+sqiG9+lEQNEvyXAvWyStNptm4SoMnzJ6gaCBpwpb6Hh30TUSzqZ\/VHo7JwFeaYBWKTkRj7JW5sU9nePfYxgWVha07X1\/Yp0HG6\/ZYpXCeiTcl8KlBeu4Z1IRD++3l417bdZ9t\/W1ixNcBngft2Tmn6XwK3kLUN739zx+b0HF7D\/LBMc8qXD+0l1ykqkVqvM24SqIqOsrMvMZtcGpR\/ZnhClXkey9bfUjMsaBM8UVUMG2CvWni5OJmLokY9Ij4fW1R+4UC3BLV3uslS\/zCG9w6+IHrGqdJJfLACPpV1j7AwUvAtANYiCp\/Gbwja1U5xoJ1xCqibVrTSwTi3lT5vY4xukosglltQT8OpBmszrzbevD+6ngeO7ACeQLbITzddUYQMI+KcawUfIDYxwZ1DvpdlU5AO302upV9tUKi0k3l9upWcO3Zfm2j7MmjVCQF4SzSqqN0TzytGvfi0mn\/ugeCdR9sUaWMt4EUBzj+xMLK8+N8nrsoGAqmizne3ar2t9RTC5udkXituiyfLQqLXvu1LEkz1f00moyQr9M6YlC1QFSIxZWBeaxYAYwR3WUaPdtZtTnoTiO32\/WKfyLVC94539o64FLEvoVoH8kHRkbkwfD5CxAYBdM3h+fIwiUXV99DxjvT+FtyszSFam0ra4RAd5gTUImyFtxI+pIgpqylojwp5nYjYb+sa4aQ+7VIs8oZP8KxnyPdrR+YbkUbPfU\/wBMJrV+2eWjGesPmDdxr8a07tgKDCwn1n2ooD2ESVLPuHYJGXXieGf+vCs+N7Px91bWs0Bf0Ydv0qmYtjAjD26hW2p6o\/xc5lXmXxbKWD9G\/DsMgLUfLcOS8GOyPZcB5tVJddLacucEGtOLoX655nwqJVI6IcAm2faL0ROg55aYqMiCGmQy6IjooTOIod9BCo7JAxKvtsRBqE1Z7UMlRJ+gYQKdvNvEgxkU1j1oa\/len7g+asjIrxhx1vmYxcffsH\/idzyaZQBV+GZM6o6ChMm3AaB3hKWmDiX4ohkU2fZsPDrrcvvwB84hPN7vi9+\/3WhMEkoON9D\/MQW6UXmeOTcGmTLet7rNfjhLJHpmFVhcxC65Kpf24CRsinECVceWtzgcAnsS9YM6Ul4M+Zw51PZqEUKGOFiWD+rxQe\/VzwJYrQ36qRv\/Y+zOPg0CDAAlYUUcPTWemf2xE\/yKWiBPmDpy8r6Qwprum8TOm+8AE55ZUDsRxb39HXAcAJ5YH4B\/0fxuswU4zKwb4JVZUkGSGk1xmzRLkhWf1nkbRvWnogi0OOO+zfbjLO9vx0mXv9ZLCB9djBWebLfYlwof5T\/AI861EpZrUETGK2rujOilbAfDcgHS8eZlMNpwGUFw6\/e0ROoEQKz\/iWotpgMLlzOzY3AMnSMJAhCdNMNQijuyoFIVZnf18v1MAhusCcipVpqiaBJC7lEf09wy\/3ZXzWBnpAKQE0fzUghvRJt2GKvKS6yE+DLguqZ\/TXdFfgG0YOyntvnGoVU8+F2tKSt\/EYWnSdUc1dXFtgdkKVvy9mF46YjFFScuuLhht6DZc\/d\/K\/dzJAw08+ePzjgjd2kdXI9SjiS8TUDlE3GEQ8PPbnZxNXomsA9vfFacOQ3B1ERICnvMHxm+3YshxOEEd7TcpGKI98sYZWhk9bQ8HNe7OmYwY1IqvjI9xdyepriq1wYd2diRs2gFRGS9ds5jwYPwCjyAezmaun1AqjNvm+ZiT\/of72CQnIqCIqp1UbR\/iN6AbgCpqFVFcU+NLVS8SIDPzHPJvLYiRtv67\/PyoRw2Z5vVL\/Z6e7PJOJ9ogZSkvVaIxZIwvN50QyfhaEbj54cU0WwjHcoCVVc3QrRf8FLfiquFIubdbspYNmBd7lQ42OrOswo\/QBuYWNOVc4aeF18\/kEFdaur3RJDRKeJNjAaR9ZdzuAi6I9azOdRCq5rGyc6TS7K4RAe8ZD4Jx2XKFmxlCj\/35ADrCBifOTlEOYURYFbi7p2g\/uC3zhxhq7OqGtgdBoEFesNQD4E34FDykSi3GK6FcSHg8\/tQ8tu3NOi78um+cGuB4ISt7FWfLtAtTZfJCaDJ4fYQ74F3K6nbl1p3cKmZjvdQLMjfn06AfJe4JqWVlzALz9Et4xT4eBikuq1euXMNBm45supiy5FvLIKh2IwkwDgLIz9QMtGgKzNJYNiwxYXhX82G+h4\/7zcu0E+dN41kaRiFedeV7NDsqEykda1IlCBSmr\/zs1h11YTHxChr6nFfOLi18lH\/d3KV7htpNKz7w2B3rsCFMaMj5rMAbIqnJSTkGFfZ7xv5FdO9DFeYXWk5RQ+9BUshI5Tl6RZzi8Kqlb\/FZBJQZKSX3FEqtM41Ifq3U9LgL1bTI\/pbccJwbhli7kQNGt8\/xKn2xd\/Qpo8a+Yb2LqHTgNmtXGQTh98SUuMxAL13+sYV6NBU80hDpuVywkDnBaFpu+87e4DGPTHDYgIcPGmnzqYcJIe6kkZoDLljz3ahsFIgF1taj3TYGB1O4V84e05px4BEjugPQQNBfm+6wx\/LDJskAYciSwp0WYxJrIbkQ1pl0L\/9hSBRVT6ptO8SgKg4auw8oUl\/eIY7uJnJLDZoeRDeZtO+2emcay0nYDD17NzfOwZRJJfta\/\/LADzcjovL1HdXbN1kFqss8btMkAoOCpzMrN1\/RKlXoq2EpoqvL3b33+ThUfia\/y5Rs+cbkiCt0iMwbUogPoj9ct3+HRD0CQJ+xvl51FAipVpqOYAMnaCEUvoqs0RIcdethNMRCjX1I3TFvyfdn6c0eA86migQFiZXAMvWvwCGHqrhR93AgIdZuqTCjCvBC4jIKYpo1I19f0i0glDo0odwuORZaP49oEDkOUYE2WrrQoKKyQ8Gt4K52Bs8qafQ0lS14lNx7oRk5Jo4+JSFDEkmt5OhWzaDXtn6EMHpkNByNUYeZYXopNLp5X3rRHBLUgETRcvH5wHZTkKxXy2a6QB0VkPkBdF4sP8wF6IWjZo10Q7UGIETFGzh4t7BQ6ou8yvjry8W3E6matFkDR6+WEhYoTAmV69oUDd34v8iThQ2jDAHP7ERyg3os3ZEpsg\/LRDac3ZdoY9e9su3IHtLe9HFZo\/RkM7ofie2wJO0HR6U0jcB3pF8mrwyYUGlEX5L0e1TleZzF+qXODPHl5cJXcttTDqnC6F1+FRVhCQ4WyB3kTAeh9Nvo5MT1FS8qtEDej8Yos+cjomxAX1nIfAZmlIpcziNDsDkk4\/l0lcjNcSGKbLwWealU7ZZ45Bu2tgxoqpqB7uluCdfFkSpsQCZGtsFa8kPknMoO96PaQuUS4UmDc3a0y3FRoebXBTnVLVuSuXbdxOpIGs6MYUeQLz8P\/Z+U00zbxlqvwwsDDSCF\/HYGcNEq5aJTRx0JyNAPclXGYZjOZiXy979CMJnRJoK8T9Eh8OQGUAjbjVOdN36PdUTEEwmy3vGCETut3oNzlt8T+AavFizTXsCvBFm4qLAfNISA9dRyxxN3HprqFs+whn5ushZtlfmJY5lyaJzM7m5XZMeNdNw\/bPgR4ybWy3U0Qn8daabOlE2CgtfnN1ikLXPxxwCDhHnfT6y2moWClsq6YYDQsFB\/s6bSwuPsQ\/TxX6WbkbwTl95gYP3Gt1fVoHeF9jQowznZbCS8+oRCObUlsaG+zqNuCixLPoDV8UZhzvzkdJL4aFSEYnpr25yv5bAisGWg3heSPEwuVrGNwBaLLvkOjrLYmve82h4pYrw1J382JVd8vCLKZLaVnF6mYm53mWbGBbXtmhZlouqoOEbP1H\/Qbk0O3rtXRC7bbYqLz7IdK+GMjq4\/o5ecWI6T2vZ3gtOQA2VTiZ\/Ba7tsDH3t3V47znDMaIZtxdP9l3cYvpZh8RpBDIIrXnpRwzAgqXMPTAZwBA3RGT9M9sJqD6GYH\/nGAQgvW2cZ6Sv6GC2GSTQfYboeXNc4\/Bib4ofAwR3zl4Q8rtws1oDI9lEVoGaLIlCoEiKpfUowg2hkFIb2pJLWzgBZgO4QqEGW6PA8rMF99htmB3NUOMqIQ1lCDJxKPF6VfiwyJq3tUnQuQ8fw+0tx8UW9FhippYm2H4rwDwQ9XzyyNuOKMZ4nTwzSZwAO0XVlYpXoAX+HQDwsIkXugrTCycvC6Herk1qalDxNT0mbkxiaEpszUdyPF8g7y0WZDGlLT8\/mSavBXePvIFczQIl\/7B8Ys9v51FKYwTkhY\/DbXIs8VvIK9MsD0aykUoUor4DTSNOxiLJrIRdyq6eEZqDqfvMGmZRJjvHGtfQTsVLqoM7SZyFTRJJLvGgyqJZKir5JENP1BaTc3COeOviA9e1VSf6ym8gszej4mqeKctEi2Y9XfCIHPLvmgyMMuIsTKR7RivSMYOwhYtUp6HqtSdrb++9yU1z6ue77m5WkianeIu43eNcomzbTxbT7NLzHTXhhJZ7F60PEuDK+jorimVmiU\/NRxxu75Xuc8\/2AJw1BwFFXzw\/Xp9xV763Uxx23PEM1N9KSvoFdFmXOjqWyBDlWvIKt6CQsSLB59d7AbIOUrfgdM9EW5xHNHl4u1+X77l2DGZd2Qi07dZaorsNngHKhEFV5zxfW681X7Xo3GfT85SdEibJT+DXpqPHNB8bJGYIbca6DWwd1SQs8Ov4VGuZck78u0YmWjVXDLoloq3dbUi3VuctA7l2hYcZH1W9M5j0lxI05SIwGvd\/obSI7oRRCuHI48HVA7sjVZjVGGKxp8LLNYyIDT\/KFrHJT3\/65p\/fL0IqDyrxyZOqm5YahO9VIRM4xd+3gi0S9sN2UTPlU\/jPyZIshSZjfvxtYIsi0dyK\/q2xejR9PFx1nP5w\/oEK2ow7AtkUbz8gTqjfvIw8msyMl36tgRihUkyU0KbgC5ovmcMtIPzEcO7bJqaKnks0M+bdvJIaAMqHWcLyjX60SFX6uFsSA+eG76J\/hCZhTXOo1pFRGGTv+9fCzM5MF\/dULPaRoLpG7f7KRAcsGby+lmtFm2EQWQXlE1mOiGlpLAXUd9lYbw3K5nO2IbiYOaX81yZm3mqGGQuFzL73ji4Qj2v\/s0WAbSJneqD0KOU13NBenULu1mrLdOIc12tLfXPm1ygc81Zq1lnyGTiRVlxskn69v9gj20X6+9XTb\/8WRlMNp962XnhjsZvw0wBNiHV5RpDrq7pXuhMlLKnhbhfmb4djex1gAOoYqPj3eeVVwlyN3PgBbswYcI7H\/RjXixoJ2gDauMwDSOuG8L9n+2tcA0KzyXh4uTxgNdh14jcg+5k2uT2\/BmJCZstVKcGAILa92nJMMXm3gHwb8xHAHIxl4x3v4GFfqabl9saUf9WRvaswG8tLyz17H8lNtJT7+WJDLr7bh4q3FxNthyp4O1sLBPaDtQBC4QF1IRNzTXtMrxrzTlwSWONtzRLGhkFrWIKBl9meYvucqSKrQtx3XIJ5OxIKD3fx5tQmRUB6Go6HrLlhzOT\/7zmuoJy5VoK21e\/LAAn8roLUCZ\/Dw8onQUajo9eZyEolh6M0+Jv75Syoxr5b3HKJMz5t8tb1jJX1MNCtzkfkobcWX4fu2bTU6VsUOSduF\/fuhcS7BvxvPjlXNOsBnAxJzpc3E9CS4+oKDD7LPnRSpFy5qIROqI6ndKLrai9woNs7iCkPv5mBsJ\/B8fa3Pz8W5tdBrthiDOdBlwjSgLUoVWL3TuarAT3cT6by5ROSpSdGQBmEtlfa52VXRxnQQNI0yYXLrARTHcde+TClbrExZNTWJ0JYvPJ25V6A1lnz9Qtrb2Lg1IcLUFeppiEgR5Sl9pxoVfdH2+PBT86TLHJfOBewnct3OBT9mum2JbaW7BN5tyP+YBHRadFYBK6xrD9wnPZvvD34qMQZ+oWxOi7BKBHeRa8x9h\/r3yqhGK5uuOE+ABymdFZul1pFCgeZigX8oe6Gw0WtXsjCc9smoxpYoz4DknRHoThb\/+ZcIOmLzSvmzfYGxX6YUafA5v+rsSOKGph1+XIu1o+\/Eex0RY4BDi3rtcL4H5+jv932c0DLyXb5CYEKiinMlQXkxGKrtvQW6wLQ4afKRu6Uis3MXYuNOq5j9ZdbExyDP+9ck6jLhwwdeXLjooekNherPTom7xIWoRHPHLro6l40G4drAMxqbgZAW2OKmblMi\/\/59cpruzLOobl+9B678hrjPfI0fEC+LzxXKnQ56\/dHJ3\/mgkDoh2v2xSO19PV3WikgScMmOW0UN5tA89xdjxgPT0e0P9ko9byOMWNyNMqIIsvYQlEJwXZ9R42uOU0eqQEKneLXTWHLZzaW7V7XAcy8IU4VbxkPUioA+sI5T1LrJGLVQHno7ANQMXjj28fqRe+n59W48ICASqDQEOBccO5Ui7Uk0sfWhH1qufPKKTHjK9eBdKO4vRFCetC04sfFIJldC9auisd+9Z3KB8r9bplFm0FtnJ9+d3xx3k\/QkRXKbZxUF1Ii1SBJ1YXi7MCWc1bgBcCFGF6kqhfSIUnEhNDL9c4komXYoOzXCta8aiT2ub\/SRBfEqtAU90IDin54koGrH8nguZMUfxj6lz9Dm8FmyzNODDq2GJT25+CKNdkEymKUfy0gLrkIQJp9F8qr7sbzLp5PDxQOkK53SAd6ezAa2qCIY8NulBo6\/qLqOA7fuZkNgXDQ8+3za8o78DoZ4bkXVCGMbu4KtOZ+9MH7TtizEatSv7jbs9d0Vo3M1OMwYlIDNckVqN8r6LA5VY1o8qI7EKMMnfvetsvbcs\/0aalZ+NAs3P\/dz6PtPSleeOqGOIvkFMmTbeisUfFlPhRy2QN8Bc9BhjSm0uF6DoFD8KLFhQmbahg2lfhOK2gOhgJT1TAqL9rqN\/8NJc87a6BQ08ogJE889pNnC9VOL31A7e5a\/XNAE8Wbuv1DuMCLwfobz43YU2gX9\/lM69a+CnXhfZMfmpU\/2oyGG5LYKM+z+PbOk20fR3\/HkUws0LjxFVWuHP+yn8Olp2KOLJlJvsRLB8XSr7vKIablrEFgIGbD1Hv6rp8g3vk4OErDjD+i3zoumhrmbhfpypx+yBQD3TyQ0mubDJqrZGmbXjUAvEOpK56r2zw6NrHmmpTb1bVHX6\/F7X+DYJuHrYVEkcDpFD5bHykD0UyYqcHupM6MNx1T2SChEJPhq43S3EJ8udUQsAngKPYin7tRo+o1Xm9za\/hJOZJVu\/UcEa9r23B1ejO5dpniipzLs4PyAYL+ijCRmymmpaDIQjcBcSX++saHt5\/tCmXkh9dwKatOnc4iLZfjvpDBD4nvqNKroXL73Qb8G\/mi6dGivya0MXxWcEEG8UlVGMnPcxJaPgUj7rowCDG8ic52fZfJxR6CLi+xc+qjZJ\/YUIqLVB0lSYo7AUqLHi7h65VZSoi8MDv10aq++4W0BrILQMrJnB1eXvCq7DvqV9Se8IOrzKtnQ6hTahAw8p6rA6pC4QqQRa4oMc1kwV7ejtfaKTARMmKSKFaqZ3hhlPyklzRx5Gr085Nnc77B7lzgWfTBf5v2usqsq4Dyx5oHFMbg4B3E1n8llqwMKV\/z4bsWzPYgpxBOZiGBzkQz3RL4yxyu9jmDKnM52XWer+Hl2LJxdByE1IbK3fJx4RT0WHkFhHg++KUFM0YgCEfDUxb5g7tUMPYz9AGWNLBwMiuZex1oAI7LJnHbrV\/mUw8jjk0VJylnpgwKiWI1OGbVDxsI3OecVz85UXaMqdxpsI4U6Q\/a80R7aGTTb9J8R2otDfvxvz9+TPyN31Ljn5ivAhDtfnNrJH16anT4+JVCkGrQ\/NOu6SjieTAt9A6KE6vkQqfUDTNmYW5OCwPETHgOGj7thevHpQK2PH50xl2QHBjFM2EQZdHvAi1SwIK2rIl8F+4\/uWiYmkkYCNkVZcwx93JoeVMR4CeWgsi87M9IetLGZxVD9h\/MgCUiMVvoBxYdmpkh9KYEGJpt6N3V8pp7+olWe1+409BZi\/4JSgK78h0WfVZkE7lLk9VsW7LvuePFekNOWX53iWPMqidShhO3sotL8hrLGt+O5CNlWMrFh+AxYD9NAPYojmmxURnLGfeQDAuH7oAnCjFTpMkKFygpDQ6PWKpNSZFwdOrMipjW26azdO825x0nC\/B8dhgE4LQ96CSnll4azOcS3F6HnirNqg7hkU+ir1fnzijqGLFb14dccLAnabJ8QTdokZNYtG+tJDXgsO8Tf2C8HWR402NxRzR+U249FHrT5cLrC9nxrXTLZ1rv6634b3i2A6a23yh2lafgr2XDbpnLsX5F9OfSvw16qqSTIfXvCiqg0DnHW0Gnxf+G2eIdeRpIcy7HAh9XeCYIkZhnY0o8huJg7XtpJFkGwbLbJWDYGbepJEwgijKfd4FmCEUCL\/qu6+WqopDnZM8cRYAlcIouw41wpshb0ExEYItuVVrO1hzn\/dgJzgPmajouQ3sioMbiRRFZhBRC7mxbms7AUOD9xpCZjNZQg4IDQ2C391lVs+kGvo5RxnHfBPa+Ojq2bblID01ninEsAFIHvSFsb5fICzhn3279R4BdlvedwFSC1V4iloVZLhAe\/ykgDTiXX0ANig7T+PucrdvoP+EZXHgNpmeOzltgsYMaoPDrK7\/G17QVo1kUNmjGW3q\/MrXTqcDArZhu3k60HRhUyIVhHSeCxeldaPi5K2o5xBdpEBSP\/Wjdtu5geRz1gApDhCwrqkFHmgk302EtbJ7lY2jkyf5xQH9sJrNnIT6XsUyvhdxkA3eIxvFyqRYc\/gvvk\/92roEl+TcLLqrzYqn3N9H0bD1bgse7mso8IqVqFXU\/1yEhv7Q3c3LrtJ2kDXnrwfMxJd+EpbSpWHHPfSxxq0KPyBFNfd0Hrp8QaikTFSwMm2sYenJHIWQj1KFJhw1008M3S434uJkfIfuXurpXbmk6wjinUh8ui8bQ7sG6uv6dFI5QlpYpNA9XAepF2MyFv81847LB\/EhFmH5U\/C5hYEYCmDIBuzZM6TIlBQrFe5LWLCD76oIwI3zvOjKxPzt1V2dKMl+WtlwRVayVksAYSf8gxPvRtJpyEQu8wNX179vxkKI2O3lQVvvKsVLrxp7JxYnSej8llCga4DSxDr7w7nh1X0XgUFlG415ZaFsp2Jpv4YgUGTwmyyI2ZXacE\/EddEdo8xb6whARIiWJhIxLT6RpdnLZ26lBkmnr9pQAk0sxUoKE5uNjP0j9zAqZ+Uk1mVjYtWsBFGYHvInA6gS6lSvM5CWZ0YJoWepQzlH7HZLSkc5dm5g9325kwBVLBDoVWl5yQvnhXcBQsUoLxSAEbYgUytpUs+Uwhbl3uDJE87zQGDuB2pb9fQhf94L\/mrFm3vuRozwQhTA8jmi4BbeubztQ9GVW4i2+Z44zVJo\/5apzPNBaN9q3SmNnM5P+I4dnl741f8Pm52IYMV1d\/W\/BfNFSL0mFVGuCNPRHOcMTifx\/tcH9COeFwW8sphEc1Qq+ugmWdDWUh8AnL7dOqfa\/d1jl69Iq6XvQORYS9IWW56OFl+TSCQDam2C\/1fjlFpfRr16DrizZg80sKzh4TkK\/o9YRCM2Lqd4CZLX\/4ez2eiRmSte9x6m1CbsqDO6k+Zf5nIZn3e3M3IquLzf+C\/yRBSuSuaMv1L7fJXi0osMToLNjYSpxliTsdrbaIOX3Sex8ktHrSBIjV+mBpn0KMXsylw5JgXnhoFAFgFBrwRA\/7fVGX\/epOBryV6ndHJLZNIpRE5NdO78pN7b+qMi\/O6C4pAJzTmlcSAcG949WnpjbQW977KHPfuadiO7ny\/Fyq7MeDeiLUVjlV3PtnoVRnIHeHqcwhKuJsgiYDnUVvpE7y27XdYp4VKGizsFYmFogUv9zm3QvpExRcGyYWXLfYmqamV0v1sKKiHzw1SFMpzn+ThUTOG7Lx+j6FspTZeP526TdJhXdt0VFRRXleU\/2lRhYIl\/4IC83VrV+FBSdAnWjxsLBuZfr18+RhUDGS2rU4ksQJ5eGG0cXHxG+BHu229LGlkQUcSkdASjfR3l4EJVFjRu3Mcs1nwG1358DuoCWthVEfcy6wHYhgBwCGLp9Td5RnGka3D\/H3FbR11XJ6FzVVsbwfIfM7T1ktYzcIIIJlvZ0A+3azDQMoA0+sIOOYMcJlazdtyYdwrvk1IAyb65ISkg3c6Nn6qNLfrfH1BaUdClm+VlaAsrUIX0VgjxzRNpWiVxwqb6vgjfmOpV+\/1AcUpslzJ9YOuqSKYY16lnE5OBbXad6rBg\/P+AxhhfscqupCbq3rGOgHbvZ8UF4bnbEW4aWYZjMrKhBsNXEG01r\/wWxEGE34VkazK5huQvNo9AfUUQrdUL9sAEgX7A4nP28ViGolL7C2BcDqDO4M1mfhz2wM47\/83nNW1UAl61lfQwY82cB8qbkSt8jRxP3dxCr0dndqk3WGRkjF\/N9kZhCoExetVv8vUEAunJf5fIRFTir28hPpszTqfBtyYKlsW5LzZLqkMeDIWab8bZSzisKFwYTc3LzQX+tZpuS1lu+UNxb4E+Jc1puMvBhD86DFD23RzKzgK9NmwuwylT3N081XTs2JbNDWFTKPGla8Z6BJGlCZClIcBu+nz\/kjmTLlD7xZzK3BqohQ5YXXLV5aMrz7NkZpfN8TPA5DD+V5VIJ7CxLqmjGdtz4g7basLLdQt3GU1xebFcsOA5aQdFO56wuffvWdlYb0q9n7rSjY3fnaMR5BWVvdIHJot7YEQPypEVKqI+uTVFcq0WjOAtORgarSTAZ98NRKAK9ibHhbYXi+2Mnnlbo6EypaqnE6W2zOR0lRR4fOkWQ\/Li\/UeYT7nOWj56tL8vGNmqDGYwE7Mb2faF\/YvRFAfHCXVtNoS0duRpzfk\/A6z7QchAAqvbdZhMXnsqDDqLQKC8nlsGPcQCgs5OsjwOTcp4NZ2tttt3q\/MVIn4oLxTRaeyS1VqX9Ml+ya5iJJbQcdSATtGyd1uSZxqqJTKAh2l3mPijJYjPKFH1pFWDrN+VM23Kn\/doORPEXTH1Kqlssxe4JkyPz8lKo4Fn51ac6dgDrrzquopdvF9lypKFcjUXjzcte3XCGpmQ90GWZ6\/PKE77DqtHsnawH+jvKihjYGeauhCFurh1ixc7lsDaEW6uEQY0PUUIwEP\/bC5or8muKNDRaKjwQ9YxNAHPBIJzQkcsabVsxZGaXoFMiBputdWYQaeHnxli+KUd2IgL8OZrJHOqI4uwRqeeYXiuJ5GQ2CYQ8ojkoVjundqcOb3O6a7K0ALCT407GMjLa7j\/ptQVtEoSrTGBZ+jLAvAIcmJloUcngwRMEUiFZv\/s4WQjmJcOCSqlus0pXRm6Bw1zvFlXA4h3Ci7P9fv3lDNsVPM8hVC\/Kkkj5iXeLtnP8Vw7gZlhH6Uj8xWEVqjm\/bw2yurLtEvp497gPhL\/qEtbccdw0wwkFochwFwNX4iWWj3fmmS+LLI96R7ke6D3XzSoiiA1cnmmyoNOHp3+S3feAOz\/5Bpozq\/SkWNWKeu6Ro6or7ZvF9YGDkNqRNh8smTq7nJdqVfirEP0srymN7g5Fxg==","iv":"5b3939fa13757e6cdc4dc3217622e458","s":"6163fb94cbd1d75e"}

Knight Frank's European prime residential forecast for 2025

Knight Frank's European prime residential forecast for 2025