Beijing skyline at sunset

Beijing skyline at sunset

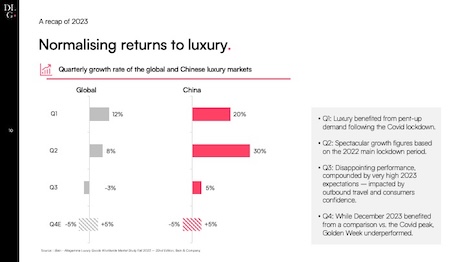

For most, early in 2023, expectations were set for Luxury consumption in China to make a ‘comeback.’

At the outset, it looked true.

However, 2023 quickly took a turn in the other direction by the third quarter.

Looking back, it is clear early expectations were unrealistic.

On the line

Performance versus an exceptionally complicated 2022 was always going to be positive, but that did not mean a return to 2021 China revenue levels for many luxury brands.

Furthermore, after decades of rapid growth, driven by the expanding and prospering middle class, a period of normalization was inevitable.

Normalizing returns to luxury. Source: DLG (Digital Luxury Group)

Normalizing returns to luxury. Source: DLG (Digital Luxury Group)

In this state of normalization, we still see luxury ecommerce in China growing. This is evident as brands continue launching flagship stores on platforms such as Tmall and JD.com, their most visible touchpoint in the world.

As such, presence on these major marketplaces also plays a critical role in shaping brand perception as Chinese luxury consumers turn to digital touchpoints along their consumer journey, even though the vast majority of luxury spend remains in offline spaces.

Coming out of 2023, brands face two major challenges.

Class of its own

Most luxury brands in China have operated and benefited for years under the premise that the middle class would continue to grow and prosper.

Currently, this set of luxury consumers face income and wealth insecurities impacting their appetite for luxury.

At the same time, the number of HNWIs has grown too, and is expected to double over the next several years.

These two different profiles contribute almost equally to the current luxury consumption in China, so most brands cannot ignore one for the other.

Luxury faces two very different segments.

Luxury faces two very different segments.

Source: DLG (Digital Luxury Group)

The second challenge is the Chinese luxury consumer abroad and domestically.

With the investments made in China during the pandemic, luxury consumers no longer need to travel abroad for the tangible benefits of better pricing, assortment and experience.

Yet, it is already clear that they are keen to keep travelling. Those who do are likely to be a different kind of consumer versus pre-pandemic days.

Focus on online storefronts, CRM

We expect 2024 to be very much in line with 2023.

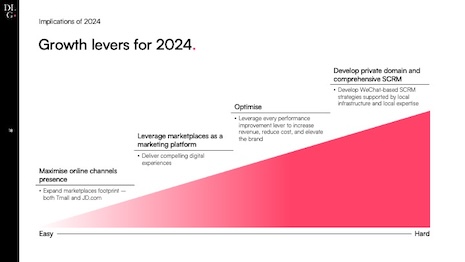

As a result, we have identified a few opportunities for luxury brands to continue pursuing growth in the China market.

For brands in the early stages of their brand footprint in the market, the table stakes are establishing storefronts on Tmall and JD.com.

More channels than that may offer additional revenue streams but should be closely scrutinized, including the cost and sustainability of operating these channels while still delivering a compelling brand experience.

Growth levers for 2024.

Growth levers for 2024.

Source: DLG (Digital Luxury Group)

For more established brands in the market, deploying a relevant CRM strategy in China is critical.

As most CRM systems are global, a CRM strategy for China often triggers a global conversation.

However, whether simple in the sense of scale and implementation, or within a full-fledged omnichannel integration, brands should give time and attention to their China CRM operations.

WeChat enables brands to capture behavioral and transactional first-party data points, which allows brands to deliver meaningful value to their clients and prospects.

Whether online or offline, domestic or abroad, WeChat is meant to be the central touchpoint – a brand hub – that the same consumer will access while moving across different consumer channels and experiences.

OVERALL, THE BEST luxury brands are starting to turn their attention to optimization.

For many, it requires resetting key performance indicators (KPIs), roles, skillsets and the overall approach.

Reproduced with permission from Luxury Society, a division of DLG (Digital Luxury Group).

Iris Chan is partner and head of international client development at DLG (Digital Luxury Group), New York. Reach her at [email protected].