Apple store on Fifth Avenue in New York. Image: Fifth Avenue Association

Apple store on Fifth Avenue in New York. Image: Fifth Avenue Association

New York’s Fifth Avenue retains its top ranking as the world’s most expensive retail destination, despite recording flat rental growth year-over-year.

The finding was part of commercial property giant Cushman & Wakefield’s 33rd edition of Main Streets Across the World report, examining retail rental rates in prime locations in cities around the world.

“The retail sector has continued to face issues head on while demonstrating its resiliency,” said Barrie Scardina, head of Americas Retail at Cushman & Wakefield, New York, in a statement.

“The near-term outlook for the retail sector remains cautious, but at the same time is nuanced between sub-sectors and geographical locations,” he said.

“At the macro level, the focus is on the strength of consumer spending. As central banks have undertaken one of the most aggressive interest rate hiking cycles in decades, consumers have shifted spending patterns and are reigning in non-discretionary expenditure.”

Hardy streets

The report focuses on headline rents in best-in-class urban locations across the world which, in many cases, are linked to the luxury sector.

The rental values in this specific segment have been relatively immune to additional discounts, incentive packages or shared risk rental models that have become more prominent in the wider retail markets globally.

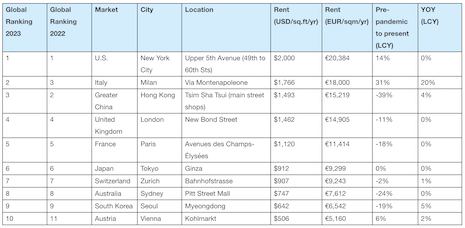

Swaps in city rankings were featured in the report.

For example, Milan’s Via Montenapoleone jumped a spot into second, displacing Hong Kong’s Tsim Sha Tsui, which placed third in 2023.

New Bond Street in London and the Avenues des Champs-Élysées in Paris retained fourth and fifth positions, respectively.

The biggest mover was Istiklal Street in Istanbul, up from 31st position to 20th, as rampant inflation caused rents to more than double over the past year.

As the world continues to emerge from the impacts of the global pandemic, prime retail destinations similarly have continued their rebound, recording mostly positive rental growth over the past year, the Cushman report said.

Rents across global prime retail destinations continued their ongoing recovery, increasing on average 4.8 percent in local currency terms over the past year.

The strongest growth was recorded in Asia Pacific, which averaged 5.9 percent, with Europe at 4.2 percent and the Americas at 5.2 percent.

Global ranking of 10 most-expensive retail streets worldwide 2023. Source: Cushman & Wakefield

Global ranking of 10 most-expensive retail streets worldwide 2023. Source: Cushman & Wakefield

NOTWITHSTANDING COMPARATIVELY strong growth over the past year, in most instances, the increase in rents did not match levels of peak inflation, the findings showed.

Furthermore, almost 60 percent of markets globally remain below pre-pandemic rental levels. This is most evident in Europe where 70 percent of markets are below pre-pandemic rents.

In contrast, in the United States, only 31 percent are below pre-pandemic levels, while 69 percent are above.

“While mentions of the pandemic have largely slipped from the headlines, the world continues to manage its economic aftershocks,” Ms. Scardina said in the statement.

“Supply chain bottlenecks along with fiscal and monetary stimulus have now given way to a period of high, although easing, inflation, rising interest rates and slowing economic growth,” he said.

“The macroeconomic trends which had become more evident in 2022 have continued through this year and will likely continue into the next.”