In contrast to China, Japan, Singapore and South Korea, other markets in Southeast Asia and India are relatively unsaturated, with limited presence of both international luxury beauty brands and visible local ones. Image credit: Kearney, LuxAsia

In contrast to China, Japan, Singapore and South Korea, other markets in Southeast Asia and India are relatively unsaturated, with limited presence of both international luxury beauty brands and visible local ones. Image credit: Kearney, LuxAsia

Southeast Asia and India are set to be the next gold-rush markets in luxury beauty across Asia Pacific, reaching a sales potential of $7.6 billion by 2026, according to a new report by brand distribution firm LuxAsia and Kearney.

Those two markets are expected to post a projected compounded annual growth rate of 11 percent between 2021 and 2031, almost tripling in size in 1o years. The findings were released in a white paper titled "Unlocking hyper-growth in Asia's luxury beauty landscape," highlighting the opportunities, challenges and solutions for luxury brands in Asia.

"Southeast Asia and India should be on the agenda of every global luxury beauty CEO as these markets are poised to lead the next stage of growth in luxury beauty,” said Siddharth Pathak, senior partner and head of consumer industries and retail for Asia Pacific at management consultancy Kearney, in a statement.

“To emerge successful in a competitive landscape, brands should have a cohesive strategy to cut through the noise and tap on the power of digitalization, data analytics and ecosystem support to improve their offerings and overall resilience," he said.

Southeast Asia is defined in the report as Indonesia, Vietnam, Malaysia, Singapore, Thailand and The Philippines.

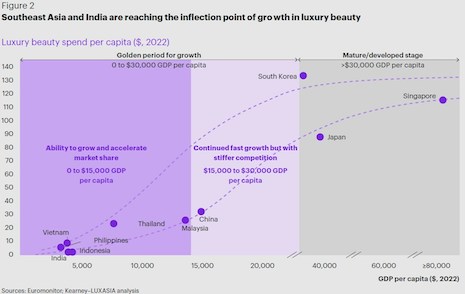

Southeast Asia and India are reaching the inflection point of growth in luxury beauty. Source: Euromonitor, Kearney and LuxAsia analysis

Southeast Asia and India are reaching the inflection point of growth in luxury beauty. Source: Euromonitor, Kearney and LuxAsia analysis

More than skin deep

The potential for growth is attractive to luxury brands.

In contrast to China, Japan, Singapore and South Korea, other markets in Southeast Asia and India are relatively unsaturated, with limited presence of both international luxury beauty brands and visible local ones, and significant upside potential for luxury beauty spend per capita, according to the report.

As these economies mature, the upper- and middle-classes are projected to surpass 1 billion consumers in 2026, with more consumers expected to trade up from mass to luxury.

Thus, this presents a limited window of opportunity for luxury beauty brands to enter now.

That said, harnessing growth remains tricky in Southeast Asia and India due to diverse market ecosystems.

Luxury brands currently face six major challenges in this fragmented region, which include multidimensional omni-retail networks; heterogeneous local product preferences; divergent marketing approaches; challenging regulatory frameworks; costly and idiosyncratic supply chain landscapes; and partner selection amid information asymmetry, according to LuxAsia and Kearney.

THE REPORT OUTLINES six execution tactics to effectively tackle these challenges. These include optimizing the retail footprint to create multi-touchpoint experience hubs; harnessing continued ecommerce growth unique to each market; forging capabilities to ride social commerce acceleration and building deep local consumer understanding through data aggregation and analytics.

Also recommended are leveraging logistics partners to build a reliable and flexible network, and partnering with the right omnichannel brand-building partners.

“New-entry brands need to act urgently to secure the platform to grow,” said LuxAsia group CEO Wolfgang Baier in the statement. “Existing market brands ought to rejuvenate their omnichannel presence, adding greater operational agility, to better navigate market developments.”