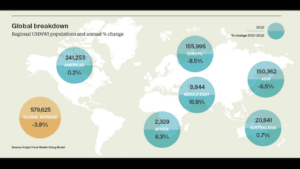

Knight Frank's global breakdown of regional UHNWI population and annual percentage change. Source: Knight Frank Wealth Sizing Model

Knight Frank's global breakdown of regional UHNWI population and annual percentage change. Source: Knight Frank Wealth Sizing Model

A boom in family offices and recognition as a growing wealth hub has led to a 9.6 percent rise in ultra-high-net-worth individuals in Singapore.

A recent update from real estate consultancy Knight Frank’s Wealth Report, 'Wealth Populations,' first launched in March this year, also shows how the global population of UHNWIs declined by 3.8 percent in 2022, after a record climb of 9.3 percent in 2021. More concerning, wealth populations in most Asian cities shrank due to factors such as slowing property price growth, but Singapore bucked the trend.

“Singapore is unique in its offerings as a global wealth management hub and financial hub anchored in political stability, low corruption rates and transparent public institutions,” said Nicholas Keong, senior director and head of Knight Frank’s Singapore Private Office, in a statement.

“It will remain a perfect base for businesses and investors seeking to capture the upside of the huge growth potential in Asia in the coming decade,” he said.

Moving up

The Lion City ranks among Asia’s top 10 fastest-growing wealth hubs along with Malaysia and Indonesia where wealthy populations have expanded by 7-9 percent, with Singapore’s UHNWI growth projected to increase 17.7 percent from 2022 to 2027.

Per Knight Frank, Singapore now joins London, Dubai and Frankfurt in the top 10 list of cities critical as world hubs post-COVID-19, based on the number and quality of flight connections.

A trend first highlighted in The Wealth Report 2022, Singapore’s arrival in the rankings underlines the city-state’s steadily increasing global significance.

Global mobility has long been a must-have for wealthy investors, fueling demand for second passports, visas and citizenships as competition to attract the footloose wealthy heats up.

While the United Kingdom, European Union and the United States still attract considerable numbers of globally footloose, wealthy residents, Singapore’s position as a wealth powerhouse is gaining more recognition, Mr. Keong pointed out.

Knight Frank's Top 10 countries for UHNWI growth. Source: Knight Frank Wealth Sizing Model

Knight Frank's Top 10 countries for UHNWI growth. Source: Knight Frank Wealth Sizing Model

Magnet for family offices

Singapore has always been a strong exporter of capital. But in the past five years, there has been fierce competition with Hong Kong to become the dominant financial hub in Asia.

Positioned as a regional leader in education and secure living, supported by a broad, pro-business economy, Singapore has in recent years made particularly large investments to strengthen its foothold as a global wealth hub, most notably via tax perks that incentivize the setting up of family offices, Mr. Keong said.

The Monetary Authority of Singapore and the Singapore Economic Board have made efforts to establish the Family Office Development Team. This is intended to improve the operating environment for family offices, deepen capabilities of family office professionals and service providers, and build a stronger community of family offices in Singapore.

The city-state’s sevenfold growth in family offices alone is testament to the size of the prize for exchequers.

An investment of around Singaporean $10 million to Singaporean $20 million is required to set up a family office, but families have been known to pool resources.

Numbers of single-family offices have jumped nearly threefold since the COVID-19 pandemic began, largely driven by an influx of wealthy Chinese families.

The rising number of wealthy individuals is fueling upward pressure on prime property prices which Knight Frank expects to continue through 2023.

Mr. Keong alluded to a recent Bloomberg article stating that Singapore is climbing the ranks among the world’s largest asset-management centers and emerging as a destination of choice for offshore wealth stewardship.

About 75 percent of assets under management (AUM) in Singapore are from diverse overseas sources, with North America and Europe each contributing about 17-18 percent of the city-state’s AUM and 33 percent coming from Asia.

Property capital inflows

According to Knight Frank, capital inflows are also expected from global high-net-worth-individuals (HNWIs), who see residential property as the safest asset class in Singapore – a title usually afforded to gold.

Some 62 percent of HNWIs intend to use property as an inflation hedge and continue to seek ready-to-move-in prime family-size homes in Singapore against tight inventory.

Please click here to download Knight Frank's Wealth Populations report